Self Employed Notice Of Assessment Singapore

As iras sends tax bills digital or paper format in batches some taxpayers may receive the tax bill earlier than others.

Self employed notice of assessment singapore. If you have employment income this must be reflected as a separate line item notice of assessment sample. While the self employed person income relief scheme sirs is a good initiative to provide financial support to the self employed and freelancers there was quite a bit of confusion ever since it was announced. If you have received full time or part time income from trade business vocation or profession you are considered a self employed person. If sep also has employment income earned as an employee should not exceed 2 300 month.

Previously self employed persons who earned income as an employee were unable to qualify for the scheme. Current year of assessment ya you or in the case of a partnership the precedent partner may e file your tax return for the current ya via mytax portal. If you are self employed and earn a yearly net trade income nti of more than s 6 000 it is compulsory for you to contribute to your medisave only. If the online tax return is not available please call 1800 356 8300 65 6356 8300 and select option 2 to obtain paper forms via post.

If you have updated your mobile number with iras you will receive an sms alert once your tax bill is finalised and ready for viewing online. Documents to prove financial hardship. Consolidated statement form b sample. If your business earns a revenue of 500 000 or more you have to submit via mytax mail email us or post the certified statement of accounts of your business at the same time when you file your tax return.

The income relief scheme was broaden to include those self employed persons also drawing income as an employee but it must not exceed 2 300 per month. The tax bill will indicate the amount of tax you have to pay. This page shows the relevant information to help you prepare and file your tax return. Self employed and freelancers can now apply for relief from 9am to 10pm daily.

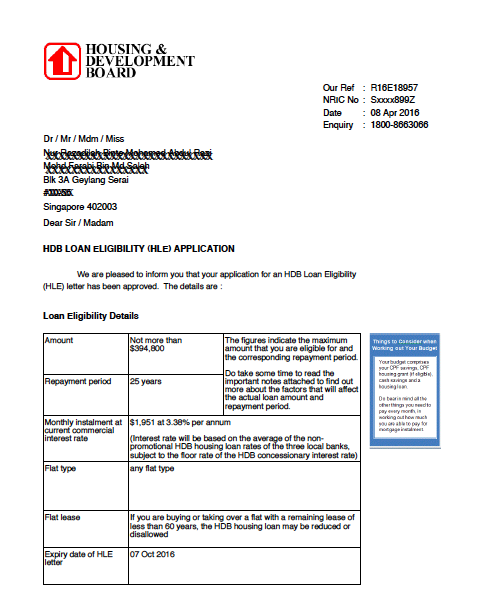

Most taxpayers should receive the tax bill notice of assessment for the year of assessment ya 2020 from end apr 2020 onwards. If you are a self employed person before 1 january 2020. Previous year of assessment s. For self employed form b.

Proof of self employment such as contracts for service or invoices dated during this time period. Statement of accounts comprises the profit and loss account and balance sheet. Contributions to your ordinary account or special account are voluntary but if you aren t actively saving and investing for your future then you might want to consider this as an option. Certified means signed by the sole proprietor of the business.

For non resident individuals form m. Notice of assessment for ya2020. You are employed outside of singapore on behalf of the singapore government. Copy of your iras notice of assessment noa consolidated statement form b for work year 2018 and work year 2019 what you submit needs to show your name and trade income.

.jpg)